North Carolina Proposed Bill to Eliminate State Tax

In recent tax news, North Carolina lawmakers have proposed a bill that would phase out the state income tax over the next decade.

The proposal, known as the "Taxpayer Bill of Rights," would reduce the income tax rate by 0.25% each year until it reaches zero in 2031. The bill would also cap the state's spending growth at the rate of population growth plus inflation and require a vote of the people for any tax increases.

Supporters of the bill argue that eliminating the income tax would make North Carolina more competitive and attractive to businesses and individuals, while opponents say that the loss of revenue would lead to cuts in essential services like education and healthcare.

North Carolina currently has a flat income tax rate of 5.25%, which is lower than many other states but higher than some of its neighbors in the Southeast. The state also has a sales tax rate of 4.75%, which is lower than the national average.

If the bill were to become law, North Carolina would become the 10th state to have no state income tax, joining states like Florida, Texas, and Tennessee.

The proposal has yet to be voted on by the state legislature, but it has already sparked a heated debate among lawmakers, business leaders, and residents. The outcome of this proposal remains to be seen, but it is clear that the issue of taxes in North Carolina will continue to be a topic of discussion in the coming months.

What does this mean for me?

If the proposed bill to phase out the state income tax in North Carolina becomes law, it would have a significant impact on North Carolinians.

This means that individuals and businesses in North Carolina would no longer have to pay state income tax, which would result in an immediate increase in take-home pay for North Carolinians. This could be especially beneficial for low and middle-income earners who would see an increase in their disposable income.

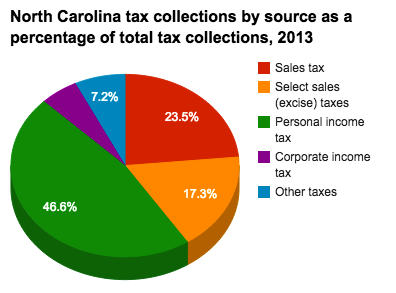

According to a 2013 report by Ballotpedia, this would cut state taxes by a massive 46%. This means an individual who earns the state median of $30,106 filing single could see an estimated saving of $866.

Are there any drawbacks?

The reduction or elimination of state income tax would also result in a loss of revenue for the state government, which could potentially lead to cuts in essential services such as education, healthcare, and infrastructure. This could have a negative impact on all North Carolinians, as they would have to bear the brunt of these cuts.

Moreover, the proposed bill also includes a cap on the state's spending growth at the rate of population growth plus inflation and requires a vote of the people for any tax increases. This means that there would be limitations on the state's ability to invest in new programs or increase funding for existing ones.

Final thoughts

Overall, the phasing out of the state income tax in North Carolina would have both positive and negative impacts on North Carolinians. While it could result in an increase in take-home pay for individuals and businesses, it could also lead to cuts in essential services, and limit the state's ability to invest in new programs or increase funding for existing ones.